Medicare Part D Formularies: How Generic Coverage Works in 2026

Jan, 31 2026

Jan, 31 2026

How Medicare Part D Covers Generic Drugs in 2026

If you’re on Medicare and take one or more prescription drugs, you’ve probably seen the term formulary on your plan documents. But what does it really mean for your wallet - especially when you’re taking generic medications? The truth is, generic drugs are the backbone of Medicare Part D, making up 92% of all prescriptions filled in 2023. And if you understand how they’re covered, you could save hundreds - even thousands - of dollars a year.

Here’s the simple version: Medicare Part D doesn’t cover drugs directly. Instead, private insurance companies offer plans that follow federal rules. These plans create a list of covered drugs called a formulary. And on that list, generic drugs are placed in the lowest tiers because they’re cheaper. But that doesn’t mean all generics are treated the same. Some cost $0. Others cost $40. And if you don’t know the difference, you could be paying more than you need to.

What Is a Medicare Part D Formulary?

A formulary is just a list of drugs your plan agrees to cover. Every Part D plan has one, and they’re not all the same. But they all have to follow strict federal rules. For example, every plan must cover at least two different generic drugs in each major drug category - like blood pressure meds or diabetes pills. That means if your plan covers one generic version of lisinopril, it has to cover at least one other.

They also have to cover 85% of all drugs in each therapeutic class. And for six especially important categories - like antidepressants, antiretrovirals, and cancer drugs - they must cover every single generic available. That’s not just a suggestion. It’s the law.

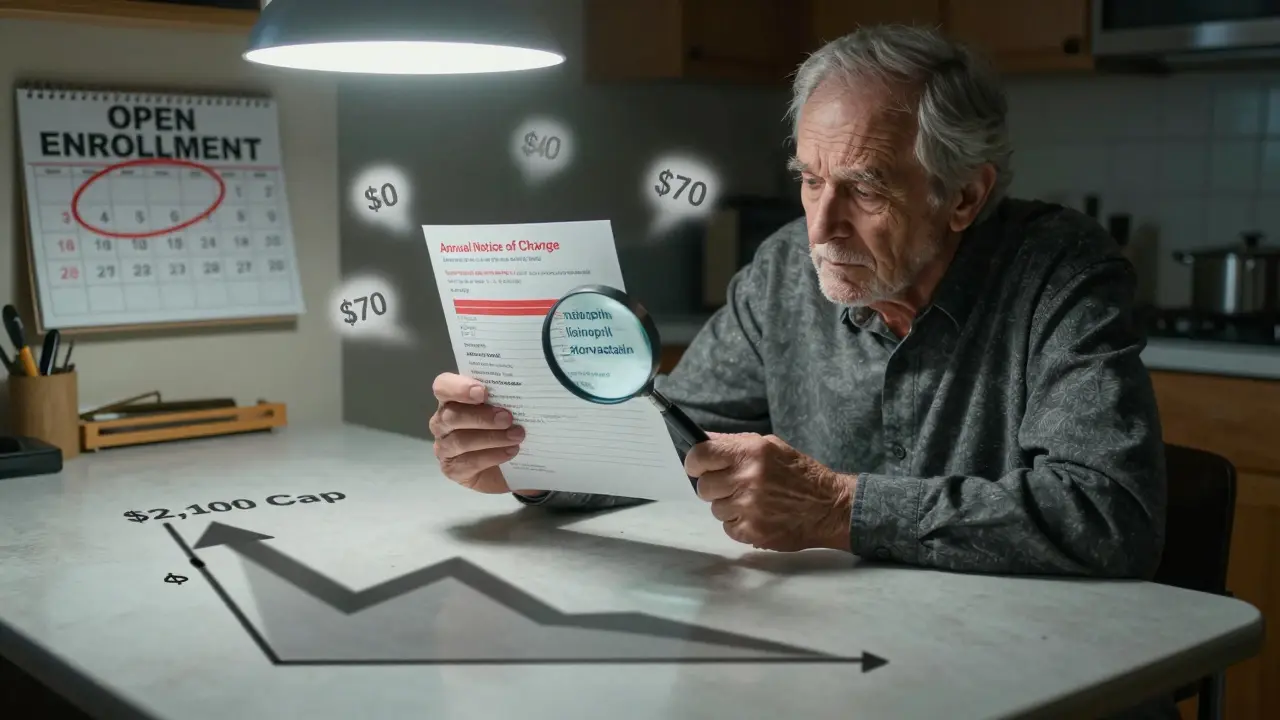

Plans can’t just drop a drug from their formulary without notice. Each fall, you’ll get an Annual Notice of Change (ANOC) in the mail. That’s your warning if your generic drug is moving to a higher tier - or getting dropped entirely. If you ignore it, you might show up at the pharmacy next year and get hit with a surprise bill.

The Five-Tier System: Where Generics Fit In

Most Part D plans use a five-tier system to organize drugs by cost. Generics live mostly in the first two tiers:

- Tier 1: Preferred Generics - These are the cheapest. Most plans charge $0 to $15 for a 30-day supply. Think of this as the “go-to” generic for common meds like metformin, atorvastatin, or levothyroxine.

- Tier 2: Non-Preferred Generics - These are still generics, but they’re not the plan’s first choice. You’ll pay more - usually 25% to 35% coinsurance, or a flat copay of $20 to $40.

- Tiers 3 and 4: Brand-name drugs and higher-cost generics

- Tier 5: Specialty drugs - often high-cost brand-name or complex generics

Why does this matter? Because your out-of-pocket cost changes dramatically depending on which tier your drug lands on. A Tier 1 generic for blood pressure might cost you $5. A Tier 2 version of the same drug could cost $35 - even though they do the exact same thing.

And here’s the kicker: plans can switch a drug from Tier 1 to Tier 2 without changing the drug itself. You’re still getting the same pill. But now you’re paying more. That’s why checking your formulary every year isn’t optional - it’s essential.

How Much Do You Actually Pay for Generics?

In 2025, the Part D deductible is $615. After that, you enter the initial coverage phase. For generics, you pay 25% of the drug’s cost. But here’s the twist: that 25% is calculated differently than for brand-name drugs.

For brand-name drugs, your out-of-pocket spending counts toward your annual limit - but so does 70% of what the manufacturer pays in discounts. For generics, only what you pay counts. That means if you’re taking multiple generics, you’re hitting your out-of-pocket cap faster.

And that’s where the big change comes in.

Starting January 1, 2025, there’s a hard cap on what you pay out of pocket for all drugs - including generics - at $2,000 per year. That’s up to $2,100 in 2026. Once you hit that number, you enter catastrophic coverage. And here’s the best part: you pay $0 for the rest of the year.

Before 2025, you’d hit the “donut hole” and pay 25% or more even after your out-of-pocket spending got high. Now? Once you hit $2,000, your generics - and everything else - are free for the rest of the year. That’s a massive win for people taking multiple medications.

Why Some Generics Cost More Than Others

You might think all generic lisinopril is the same. And technically, it is. But your plan may only cover one brand of it - say, the version made by Teva - and not the one from Sandoz. If your pharmacist tries to switch you to Sandoz, your plan might say no. And if you insist on the other one? You pay full price.

This is called therapeutic interchange. It’s legal. But it’s confusing. And it’s a top complaint among beneficiaries. In 2024, 23% of all Part D complaints were about generic substitution issues.

One Reddit user, MedicareVeteran82, shared that his plan covered one generic blood pressure drug - but not another, even though both were FDA-approved and chemically identical. He ended up paying $120 a month out of pocket because his doctor prescribed the “wrong” generic.

That’s why you need to know your plan’s formulary by name. Don’t just look up “lisinopril.” Look up “lisinopril 10 mg Teva.” That’s the exact version your plan covers. If your doctor prescribes a different one, ask them to switch it - or request a coverage exception.

How to Save Money on Generics in 2026

You don’t have to guess. Here’s how to make sure you’re getting the best deal:

- Use the Medicare Plan Finder - Go to medicare.gov and enter every drug you take. Filter by “lowest cost.” The tool will show you which plan saves you the most on your specific generics.

- Look for $0 deductible plans - Over half of Part D plans in 2025 have no deductible. If you take three or more generics, this can save you hundreds before you even hit your 25% coinsurance.

- Check your tier placement - If your generic moved up a tier, ask your pharmacist if there’s a preferred alternative. Often, the same drug is available on Tier 1 under a different brand name.

- Request a coverage determination - If your generic isn’t covered, you can ask your plan to cover it anyway. In 2023, 83% of these requests were approved. You just have to ask.

- Watch for the new price comparison tool - Starting in 2026, every Part D plan must offer a tool in their member portal that shows you the lowest-cost generic alternative in your drug class. Use it.

People who use the Plan Finder save an average of $427 a year. That’s not a guess. That’s from KFF’s 2024 data. If you’re on three or more generics, you’re probably in the top 10% of savings potential.

What’s Changing in 2026 and Beyond

The Inflation Reduction Act didn’t just cap your costs - it’s changing the whole system.

In 2029, Medicare will start negotiating prices for some generic drugs. Insulin glargine (the generic version of Lantus) is already on the list. That means its price could drop dramatically - and other generics may follow.

Also, by 2027, experts predict 95% of Part D beneficiaries will have access to $0 copays for at least half of their common generics. Right now, it’s 78%. That gap is closing fast.

And Congress is talking about a rule that would force plans to cover all generics in a class if they cover even one. That would end the “one generic only” problem once and for all.

Real Talk: What Beneficiaries Are Saying

People on Medicare are divided. Some love the system. Others feel trapped.

SmartSenior2024 posted on Reddit: “My three generic heart meds cost me $0. I save over $300 a month. I wish I’d known about this sooner.”

But another user, who asked to stay anonymous, said: “I take four generics. My plan covers three. The fourth is on Tier 3. I pay $70 a month. I asked for a switch. They said no. I can’t afford to change doctors or meds. I’m stuck.”

That’s the reality. The system works great if you know how to use it. But if you don’t, you can get buried under confusing rules and hidden costs.

The good news? You’re not alone. And you don’t have to figure it out alone.

What to Do Next

If you’re on Part D and take generics:

- Open your mail. Find your Annual Notice of Change. Check your drugs.

- Go to medicare.gov. Use the Plan Finder. Enter every generic you take.

- Call your plan. Ask: “Is my generic on Tier 1? If not, what’s the preferred version?”

- If you’re spending over $1,500 a year on meds, you’re close to the $2,000 cap. Once you hit it, your drugs are free for the rest of the year.

You’re not just saving money. You’re protecting your health. Skipping meds because of cost is dangerous. But with the right plan, you don’t have to choose between your health and your budget.

Are all generic drugs covered under Medicare Part D?

Not every generic is covered - but nearly all are. Every Part D plan must cover at least two generics in each drug class and at least 85% of drugs in each category. For six protected classes like antidepressants and cancer drugs, plans must cover every FDA-approved generic. However, plans can exclude generics used for weight loss, fertility, or cosmetic purposes. Always check your plan’s formulary to confirm coverage.

Why is my generic drug more expensive this year?

Your plan may have moved your generic from Tier 1 (preferred) to Tier 2 (non-preferred), or switched to a different generic version that’s not covered at the lowest cost. This is called a formulary change and happens every year. You’ll get an Annual Notice of Change in the fall. If your drug’s cost jumped, compare plans during Open Enrollment to find one that covers your specific generic at a lower tier.

Do I pay less for generics than brand-name drugs in Part D?

Yes, significantly. Generics are placed in lower tiers, with copays often $0-$15 compared to $40-$100+ for brand-name drugs. During the initial coverage phase, you pay 25% coinsurance for both - but the base price for generics is much lower. Plus, only your actual payments count toward your $2,000 out-of-pocket cap for generics, while for brand-name drugs, manufacturer discounts also count. That means you reach the cap faster with generics.

What happens after I hit the $2,000 out-of-pocket cap?

Once you hit $2,000 in out-of-pocket spending for all drugs in 2025 (or $2,100 in 2026), you enter catastrophic coverage. At that point, you pay $0 for all covered drugs - including generics - for the rest of the calendar year. This change, effective January 1, 2025, eliminated the old “donut hole” and ensures you won’t pay more than $2,100 annually, no matter how many drugs you take.

Can I get a different generic if my plan doesn’t cover the one my doctor prescribed?

Yes. You can ask your doctor to switch to a generic version that’s on your plan’s formulary. If that’s not possible, you can request a coverage exception from your plan. You’ll need your doctor to explain why the preferred generic won’t work for you. In 2023, 83% of these requests were approved. You can also ask your pharmacist if a therapeutically equivalent generic is available at a lower cost.

Will Medicare start negotiating prices for generic drugs?

Yes. Starting in 2029, Medicare will negotiate prices for selected generic drugs under the Inflation Reduction Act. Insulin glargine (generic Lantus) is already on the list for 2026. This could lead to major price drops for other commonly used generics. Plans will be required to cover these negotiated prices, which could make many generics even more affordable - possibly $0 or close to it.

Final Thought: Know Your Plan, Save Your Money

Medicare Part D’s generic coverage is one of the most powerful tools in the program - if you know how to use it. The system is designed to push you toward lower-cost options. But it doesn’t work unless you pay attention. Check your formulary. Compare plans. Ask questions. Use the tools available. You’re not just saving money. You’re making sure your health doesn’t depend on how much you can afford to pay.

Deep Rank

February 1, 2026 AT 17:23Lilliana Lowe

February 2, 2026 AT 21:48Chris & Kara Cutler

February 3, 2026 AT 07:02Ed Di Cristofaro

February 4, 2026 AT 00:27